Happy day, you turkeys! Just one more day before Uncle Dave gloats about your crypto cheerleading last year. Our advice: Ixnay the “buy the dip” chatter this year.

In this issue:

On layoffs On layoffs

Fab funding Fab funding

—Kristen Talman, Drew Adamek

|

|

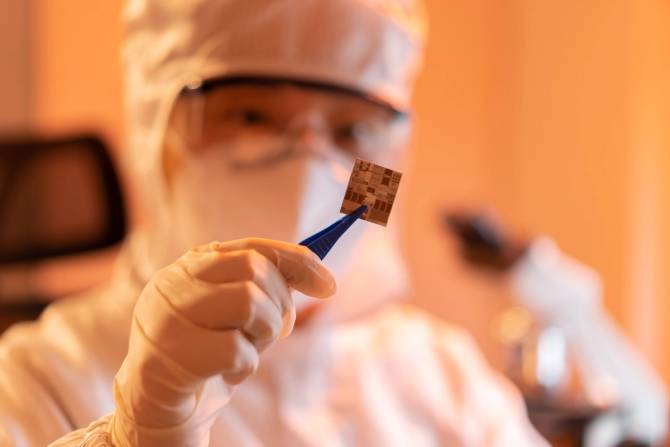

Uzenzen/Getty Images

In recent weeks, layoffs have hit the tech ecosystem hard. From industry giants like Meta and Amazon, to ride-share company Lyft, and cloud provider Salesforce, many employees are now rearranging their lives in a fraught macroenvironment (and that’s not even mentioning Twitter, which has a set of unique post-acquisition issues all its own).

But how does a company decide when and how to let employees go—and is there a strategic checklist that CFOs follow when making the call to reduce headcount?

“What often happens is the process really starts well in advance of any type of decision,” Russ Porter, CFO of the Institute of Management Accountants, told CFO Brew. “And it starts with people doing strategic planning and scenario planning, and envisioning: What happens if the market turns down? What happens if our revenue doesn’t materialize the way we’re expecting?”

While layoffs can feel sudden for employees on the receiving end, Porter said the scenario planning begins when data starts trending downward. “It’s almost never about what I’m seeing today. It’s very often about what today’s results mean for the longer-term future.” Financial planning and analysis (FP&A) teams may even be asked to sign non-disclosure agreements (NDAs) while they’re running projections, to prevent word of job cuts from leaking out before the company is ready.

Laying employees off should never be the first line of defense, Porter told CFO Brew, and said companies facing lower projected revenues usually will cut back on discretionary or travel expenses first. “People are one of the last things that companies want to shed,” he said.

When determining whether layoffs are necessary, Christina Ross, CEO of FP&A planning company Cube, told CFO Brew that—even though most people don’t—it’s really the time to “understand and make sure you’re clear on your business strategy” before anyone jumps to conclusions around cutting headcount.

Read more here.—KT

|

|

TOGETHER WITH IMA® (INSTITUTE OF MANAGEMENT ACCOUNTANTS)

|

|

Routine tasks can get pretty mundane. The best leaders help their teams—and themselves—think more strategically and go beyond everyday work.

Earning IMA’s CMA® (Certified Management Accountant) certification can help your team master today’s most in-demand business and accounting skills. Upon completion, they’ll be equipped to make better business decisions and become smarter business partners—and so will you.

Sign up your team today and get 40% off the CMA entrance fee and IMA® (Institute of Management Accountants) membership with code FALL40. The offer expires November 29. Enroll now.

|

|

Sinology/Getty Images

Putting your money where your mouth is ain’t easy, especially when your mouth is talking about billions of dollars. But sometimes, to use another hack phrase, you gotta put up or shut up. Or, you know, spend to save! Skin in the game! Whatever cliché works for you.

That’s particularly true when it comes to building supply-chain resiliency. The supply-chain disruptions of the last several years exposed vulnerabilities and risks in critical industries. Fixing those problems is costly and complicated.

Take semiconductors. There’s a narrow funnel of semiconductor production running through geopolitically risky Taiwan and many industries found their supply of semiconductors choked off during the pandemic. Nearly all of the world’s semiconductor manufacturing was outsourced to Taiwanese companies over the last two decades, and there is little chip-manufacturing capacity outside of Taiwan. One firm alone, Taiwan-based Taiwan Semiconductor Manufacturing Company (TSMC), controls over half of the world’s semiconductor foundry production.

Governments, companies, and think tanks the world over are now looking for ways to bolster and protect semiconductor manufacturing and supply chains. Paying for those solutions requires financial creativity, innovation, and cooperation.

Case in point: To reshore semiconductor manufacturing, US chip maker Intel started building two new semiconductor foundries in Arizona last year, at an estimated cost of $20 billion. In August 2022, Intel announced a new $30 billion funding model for the Arizona facility.

“To build these $30 billion fabs [fabricating facilities] is not something that even Intel can do on its own,” said Intel CFO David Zinser during a fireside chat at the MIT Sloan CFO Summit last week.

Read more here.—DA

|

|

|

Got a New Year’s resolution? Plan to hit the books or start using that gym membership? Consider prioritizing your biz’s purchasing solutions in 2023. Teampay’s all-in-one spend platform automates reconciliation and eliminates expense reports so you can breeze through Q1. Complete a qualified meeting prior to Dec. 6 and get a $100 Mastercard gift card.*

*Conditions apply.

|

|

Today’s top finance reads.

Stat: 3.75%. That’s the projected default rate of US companies in a “shallow recession,” according to a recent S&P Global Ratings note. An even deeper recession could lead to corporate debt default rates as high as 6%. (Bloomberg)

Quote: “This all can be settled through negotiations and without a strike.”—SMART Transportation Division president Jeremy Ferguson said after members of his union rejected the railroad labor deal announced in September, the fourth union out of 12 to do so. If a deal can’t be reached, rail workers could go on strike as early as December 9. (the Wall Street Journal)

Read: What’s happening at Twitter is history repeating itself, according to the New York Times’s Ryan Mac and Jack Ewing, who find the same pattern of bluster and dictatorial management at Elon Musk’s other companies. (the New York Times)

Teamwork: Automating workflows and aligning engineering processes to outcomes can optimize your budget strategy across the entire organization. Learn how Jellyfish DevFinOps can streamline your financial analysis and drive more effective R&D + business outcomes.*

*This is sponsored advertising content.

|

|

Buy now pay later (BNPL) products are gaining popularity. By 2026, almost 40% of US internet users will use BNPL. Download our report to find out where BNPL is headed.

Get your free report now.

|

|

-

Amazon is on track to lose roughly $10 billion on Alexa and other devices like Echo this year, an employee told Business Insider.

-

Disney CFO Christine McCarthy was reportedly among several investors and top execs who expressed a “lack of confidence” in former CEO Bob Chapek, who was recently replaced by prior CEO Bob Iger.

-

Airlines are on the path to profitability next year for the first time since 2019, according to the International Air Transport Association.

-

Beyond Meat is laying off 200 employees as the company’s growth slows, raising bigger questions about the future of plant-based meat alternatives.

-

Domino’s Pizza signed a deal with General Motors to pivot to electric vehicles for its pizza delivery drivers.

|

|

Catch up on top CFO Brew stories from the recent past:

|

|

|