Hello, and welcome to a big week for earnings reports. We’ll be hearing from a host of companies, including Amazon, Meta, UPS, and Crocs, the footwear of choice for medical professionals and Al Pacino.

In this issue:

— Drew Adamek, Tom McKay

|

|

Marna Ricker

Global tax rates are about to change for some companies as the Organization for Economic Cooperation and Development’s (OECD) new global minimum tax inches closer to reality. Organizations subject to the tax will need to pay close attention to the global legislation and focus on collecting and analyzing data in new ways, Marna Ricker, EY’s global chair of tax, told CFO Brew.

The global minimum tax of 15% on the profits of multinational corporations with more than €750 million ($827 million at the time of writing) in financial statement revenue was passed by 136 countries in October 2021 and is set to take effect on January 1, 2024. The agreement is aimed at big multinational corporations like Google, Apple, Pfizer, and Amazon that have established operations in low-tax havens like Ireland.

EY has been surveying tax and finance professionals to gauge how they are navigating the change. Ricker recently spoke with CFO Brew about how finance professionals should be preparing for what she calls “the most significant shift in tax policy we’ve had in a century.”

For the finance professionals who need to be concerned with this, what should they be doing to prepare, particularly on the financial management and the financial reporting side?

We are getting new country legislation at a very rapid pace. As companies are digesting this, the first thing I would tell you is that tracking that legislation is really important. The next thing is, this is a very data-intensive exercise. There’s more than 200 additional data points that need to be collected. This is a financial accounting base for the calculation itself, it’s not the normal income tax calculation.

So there’ll be a handful of things I say: Follow the legislation, make sure you’re getting ahead of the data, get the modeling done, and make sure you’re engaging with the OECD to tell them, “This is what we need to see and hear from you in order to implement this.”

What are organizations telling you about how they are anticipating increased compliance costs? Keep reading.—DA

|

|

TOGETHER WITH ORACLE NETSUITE

|

The economic landscape can change at the drop of a hat. And business leaders can’t just wait around for the next fedora to fall—you have to lead. Oracle NetSuite’s new guide about preparing for economic fluctuations can help you bring stability to uncertain times.

It all comes down to effective, flexible planning. Whether that’s through building customer and supplier health into your cash flow calculations or by developing tiered forecasts, you can be prepared and mitigate risk.

Oracle NetSuite’s guide provides a working plan to make your business more resilient, including how to:

- extend payment terms with vendors

- delay hiring for noncritical roles

- harness the right tech for scenario and cash flow planning

Get the full guide.

|

|

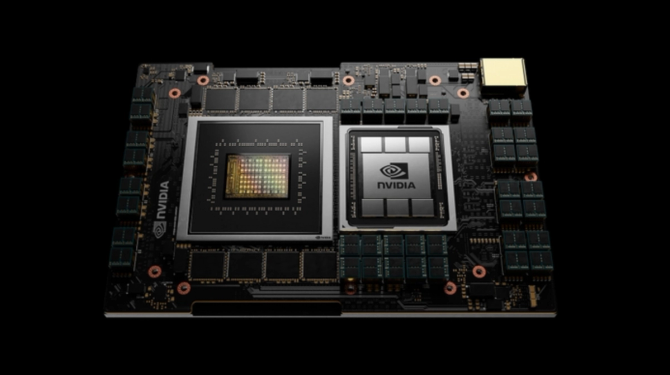

Nvidia

AI devs are being stymied by an industry-wide shortage of GPU capacity at server farms, The Information reported, with Amazon Web Services, Microsoft, Google, and Oracle all limiting access.

AI development is heavily dependent on graphics processing units (GPUs), which offer parallel processing that helps power through machine learning workloads at greatly accelerated rates. Chipmaker Nvidia, which historically specialized in GPUs for gamers, is now the dominant player in manufacturing them for server farms.

According to The Information, current shortages may be driven not by supply-chain issues, but by chipmakers not having anticipated the gold rush on AI development. Erik Dunteman, CEO of GPU server startup Banana, told the site that the situation is exacerbated by large cloud providers’ practice of renting the servers out on an always-on basis. This ensures access to customers, but means many GPU servers are sitting idle during client downtime.

“It is literally not possible to get access” to the necessary servers “unless you have some existing contract with [major cloud providers] or you’re pre-paying for it,” Yasyf Mohamedali, Root Ventures engineer in residence, told The Information. Naveen Rao, CEO of AI software firm MosaicML, told the site that wait times for servers from the major cloud providers are now measured in months.

Continue reading on IT Brew.—TM

|

|

Coworking is a weekly segment where we talk to CFOs and others in the finance space about their experiences, their companies, and the larger economy. Let us know if you are—or you know—a CFO we should interview.

How would you describe your job to someone who doesn’t work in finance?

Each work day is new and exciting because I wear many hats as a chief financial officer. I’m a part-time fortune teller when forecasting, a part-time scorekeeper when evaluating metrics to make informed data-driven decisions, and a part-time repairman in case something goes wrong.

How do you think the CFO role has changed over the past five to 10 years, both for you, and in general?

CFOs have shifted their risk-management focus. Internal threats to accounts payable and accounts receivable have always been present. However, over the past five years, external threats have dramatically increased, requiring CFOs to have more visibility into the day-to-day operations of their company.

Fraud schemes like vendor impersonations and business email compromise mean that our business’s daily activities now require an investment from the CFO to ensure practices and policies are in place to protect our organization. One small mistake can cost a company millions of dollars.

Keep reading.—DA

|

|

|

Safekeeping that saves. Here’s a frustrating paradox: Fraud costs $$$, but fraud prevention sure isn’t cheap either. How to stay secure while maximizing budgets? Plaid’s got the answer. Their new guide will show you how to calculate the value of identity verification so you can prevent fraud and boost your bottom line. Read it here.

|

|

Today’s top finance reads.

Stat: $68 billion. That’s how much Credit Suisse saw in asset losses in the first quarter as the Swiss bank teetered on collapse. (Reuters)

Quote: “Finance people tend to be inherently conservative. Managing risk is always going to be at the core of the finance role. There will need to be guardrails and CFOs would like to see where information is being shared.”—EY’s Myles Corson, on the speed with which AI is entering finance (the Wall Street Journal)

Read: Disney CFO Christine McCarthy restructured the company’s finance team ahead of layoffs this week. (Insider)

|

|

-

Johnson & Johnson’s consumer healthcare spinoff is valued at $40 billion ahead of a planned IPO.

-

Bed Bath & Beyond filed for bankruptcy and started a liquidation sale. (Asking for a friend: Will the blue 20% off coupons hold any value because we have A LOT of them saved up for retirement.)

-

Anheuser-Busch InBev placed two executives who managed the collaboration with a transgender activist and influencer on leave after a conservative backlash prompted boycotts.

-

Commercial real estate is looking shaky with major implications for the US economy.

|

|

|

Money Scoop’s Salary Negotiation guide was created for you to master all of the tips and tricks to increasing your pay. It’s free and you deserve a raise—so check out the guide here.

|

|

Catch up on top CFO Brew stories from the recent past:

|

|

|